In our virtual and paperless generation, it’s easy to keep tabs on your checking account balance without really taking the time to review each monthly transaction. You know about how much you’ve spent, so at first glance it all seems “about right.”

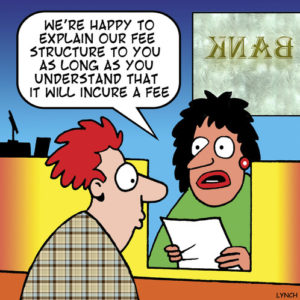

What you may be missing, though, are some changes to your bank’s policies where they now charge fees for some of the things you do…or do not.

1. Minimum Balance Fees. These sneaky fees are becoming more common, and they penalize you for not maintaining a certain amount of money in your account each month. Some banks offer ways around this — such as waiving the fees if you have your paychecks direct deposited – but their hopes are generally that you won’t notice the $5-$8 they siphon from your already bare minimum finances.

2. ATM Fees. Most ATMs warn you before they charge the extra $2.50+ to use their “this-is-not-your-bank” ATM, but not always. One way to avoid this fee is to get cash back the next time you’re at the grocery store or other place that lets you use your debit card. Another is to go with an online bank that doesn’t have to charge fees to keep its doors open and will either reimburse the ATM charges or have partnerships set up so you won’t incur any fees in the first place.

3. Overdraft Fees. This is another one of those fees that penalizes you for not having enough money in your account. Not only will your bank charge you for not being paid what you’re worth in the first place, but often times so will the business you were trying to pay in the first place. To avoid these $25-$35 charges the next time your funds are low, check with your mobile provider (or whomever) to see if they can either move your payment date or split the payment into two. You can also ask your financial institution if they have overdraft protection and what all comes with that (such as another fee to avoid being charged the first fee).

And of course if you’d like a little more guidance on the best ways to make your money work for you, connect with us here. We’ve done the legwork so you don’t have to!